How To Trade Dark Pools In Day Trading

Day Trade The World » Trading Blog » How to Trade Dark Pools in Day Trading

The stock where traders and investors meet to buy and sell shares and other types of assets. In the United States, brokersprovide their investors a lot of information that help them understand the order flows and movements of key assets.

We have covered briefly about this information when we looked at level 2and time and sales concepts.

In this report, we will look at another relatively unknown concept known as dark pools and how you can use it in the market.

Page Contents

Agency Or Exchange Owned

These dark pools are set up by public exchanges and agencies. They allow their clients the benefits of anonymity and secrecy while executing their orders.

These dark pools act like agents. Its a way for the institutions to access these dark pools easily. Then theyre able execute their trades and access high liquidity.

Flowalgo Is A Data Algorithm That Tracks Down Smart Money Transactions In The Stock And Equity Options Markets It Actively Monitors The Tape Market Wide

Smart Money Transactions, Front and Center.

FlowAlgo identifies Smart Money transactions by analyzing various data points on each order as they hit the tape including the order type, order size, the speed of the order, the pattern in which the order fills, the order volume, average volume, among many more.

Realtime, On-Demand, and Algorithmically Curated.

FlowAlgo tracks down only what’s truly valuable. Leaving out everything you don’t want or need. Every order that FlowAlgo reports to you has a high potential of being market moving.

You no longer have to dig for data or maintain complex spreadsheets. Order data is alerted to you in realtime and available at anytime, on-demand.

Recommended Reading: Can Lice Live In Chlorine Pools

How To Spot Dark Pool Activity

There are a host of simple tricks you can use to indirectly spot activity in a dark pool. As an individual investor, you cant really peer into the pools themselves. But you can see traces of their transactions on the public markets.

Its a bit like looking out the window to see how windy it is. The wind itself is invisible, but you can indirectly gauge its presence by watching the leaves blow around.

One simple way to spot dark pool activity is by monitoring the internet. Financial journalists are constantly racing to report on big institutional trades. And theyre not easily deterred by something like a private computer network.

If you dont trust the journalists to get the scoop, then consider setting up Google Alerts for various mutual funds and other institutional investors. They are eventually required to disclose all of their trades, even if its a while after the fact. By making sure youre the first to know about dark trades, you can get ahead of the public in making money off of them.

Finally, our Chief Investment Strategist Alexander Green is very familiar with dark pool investing. His years of experience on Wall Street have taught him exactly how to spot these quiet but massive trades.

How To Use Time Segmented Volume Indicator

Giant Buy Side Institutions which is the Market Participant Group that uses Dark Pools aka Alternative Trading System ATS venues are often hard to find. These giant Mutual and Pension Funds have 90 trillion in assets worldwide and control vast quantities of shares of stocks as well as other investment assets. However they no longer trade on the exchanges where everyone can see their huge lot orders of 100,000 to 500,000 shares. Instead they are permitted to trade the Dark Pool venues and delay their orders being posted until the end of the day or after market close. They are also trading several hours ahead of market open.

It is easy to find their activity if you know where to look on stock charts.

Time Segmented Volume TSV is one of Wordens indicators that was specifically designed to find large lot activity. As the market has become more fractured with many more trading venues, more complex orders for professionals, and more Market Participant Groups, TSV has actually improved dramatically in revealing where the largest lot buyers and sellers are trading making it possible to exploit the Dark Pools buying action.

Since the Dark Pool orders are bracketed and control the entry, it is imperative to use an indicator like TSV to give easy, reliable, and simple to interpret signals that tell in advance of price moving up or down where the Dark Pools are trading.

You May Like: Best Sealer For Stamped Concrete Pool Deck

Dark Pool Indicator Conclusion

The dark pool indicator is a great tool which is proprietary, but gives you an edge in trading. The best thing you can do if youre a serious trader is study the way the indicator works for months so you can understand how to best use it. I date and save my charts and go back later to review. I take notes and blog about the levels in our newsletter.

Agency Broker Or Exchange

These are dark pools that act as agents, not as principals. As prices are derived from exchangessuch as the midpoint of the National Best Bid and Offer , there is no price discovery. Examples of agency broker dark pools include Instinet, Liquidnet and ITG Posit,;while exchange-owned dark pools include those offered by BATS Trading and NYSE Euronext.

You May Like: How To Lower Cya In Pool

An Introduction To Dark Pools

Charles is a nationally recognized capital markets specialist and educator with over 30 years of experience developing in-depth training programs for burgeoning financial professionals. Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more.

Dark pools are private exchanges for trading securities that are not accessible by the investing public. Also known as dark pools of liquidity, the name of these exchanges;is a reference to their complete lack of transparency. Dark pools came about primarily to facilitate block trading by institutional investors who did not wish to impact the markets with their large orders and obtain adverse prices for their trades.

Dark pools are sometimes cast in an;unfavorable light but, in reality, they serve a purpose. However, their lack of transparency makes them vulnerable to potential conflicts of interest by their owners and predatory trading practices by some high-frequency traders.

Critiques Of Dark Pools

Although considered legal, dark pools are able to operate with little transparency. Those who have denounced HFT as an unfair advantage over other investors have also condemned the lack of transparency in dark pools, which can hide conflicts of interest. The Securities and Exchange Commission has stepped up its scrutiny of dark pools over complaints of illegal front-running that occurs when institutional traders place their order in front of a customers order to capitalize on the uptick in share prices. Advocates of dark pools insist they provide essential liquidity, allowing the markets to operate more efficiently.

You May Like: How To Remove Hard Water Stains From Pool Tiles

Benefits Of Dark Pools

Dark pools offer advantages, mostly to the institutional investors who benefit with the fact that their trading information is not public. As such, the investor is buying blocks of shares, is able to keep their information private and thus buy at a good price.

Also, these buyers are able to keep their transactions anonymous. In addition, among the dark pool providers, there is also excellent trade execution. Finally, there is the benefit of using this data in high-frequency trading.

What Is A Dark Pool In Trading And Are They Legal

Posted on November 5, 2020 by Bullish Bears Dan – AI Trading, Dark Pool

Have you heard of dark pool trading? The stock market is dynamic and vast. Each component works together in harmony to create a financial ecosystem in which investors and traders can participate.;There are billions of dollars floating around in this marvelous creation. As a result, there are a lot of aspects in the financial markets that one has to understand in order to master the art of trading and investing. One such aspect is dark pool trading.;

Now, you may wonder what exactly dark pools are? In this article, well discuss and introduce you to dark pools and explore everything there is to know about them! So lets get started!

Read Also: How To Heat An Above Ground Pool

Dark Pool Time Frames

Check both time frames for your entries! I always check the 1 minute chart before I enter a swing or day trade. I will never ignore the dark pool setting. Keep in mind that dark pools are the most powerful and sneaky forces in the market. Meaning, they work in the shadows to build positions without impacting price. However, we know they impact price, as anyone who has used FlowTrade and seen a fresh dark pool print well knows.

A fresh print till often cause a large move in either direction, depending on what the dark pool indicator is reading.

Why Are Dark Pool Prints Important For Traders

Understanding dark pool prints is critical for identifying upcoming market movements, changes in trends, and support and resistance levels.

Dark pool prints are a leading indicator of upcoming market movements.

This is especially true for major indexes like SPY. Historically, SPY dark pool prints have proved to be a powerful leading indicator of large upcoming market movements. A pattern of multiple large trades with bullish characteristics has predicted very large bullish swings in the overall market, and the opposite pattern has predicted major downturns.

Dark pool prints can signal the beginning of a trend or a change in trend.

Dark pool prints have proved just as powerful at indicating the beginning of a trend or a reserval for any ticker. A pattern of multiple large trades with bullish characteristics on a ticker with otherwise bearish characteristics can indicate a change in trend, or the same pattern can indicate the beginning of a trend on a ticker otherwise trading sideways.

Dark pool print accumulation can identify support and resistance levels.

Dark pool prints provide the full picture of market value.

Without the full picture of dark pool prints, traders could end up paying too much for an equity security. Consider the retail trader in the example above who was unaware of a large dark pool trade that would have impacted the share price had it been traded through a public exchange.

Read Also: How Do You Get Iron Out Of Pool Water

Ill Teach You How To Stop Guessing When Stock Prices Will Move And Let The Dark Pools Show You

Hi, Im Stefanie,

I learned about the Dark Pools working as a traders assistant at one of the biggest firms on Wall Street.

I knew absolutely nothing about trading when I started, but the trader I worked with took me under his wing. He taught me how to fully utilize the Dark Pools, and helped me become the first female Rookie Trader of the Year at this huge Wall Street firm.

Then something happened I became a mom. As you know, that changes everything. Initially I thought I had to give up my trading career. Then I figured outa way to track the Dark Pool trading activity from home. Seeing these huge trades before they move stock prices… allows me to pick successful trades more than 90% of the time!

What does that mean to you? It means if you had taken every trade Ive called out over the past 4 years you would have made triple digit returns every year

Every trade Ive selected over the last 4 years has been documented. Ive even recorded them on video. I love using video because it allows me to share things with you as if you were right here by my side. Thats why in addition to my book, I also created a companion DVD so you can look over my shoulder as I explain how to see into the Dark Pools and profit from them.

Best of all, anybody can do this. You dont have to buy special software. With the secrets in my book, you can get access, and see the Dark Pool trading activity for FREE.

Happy Trading,

100% Free. Just cover $8.95 shipping!

TERMS AND CONDITIONS

TERMS OF USE

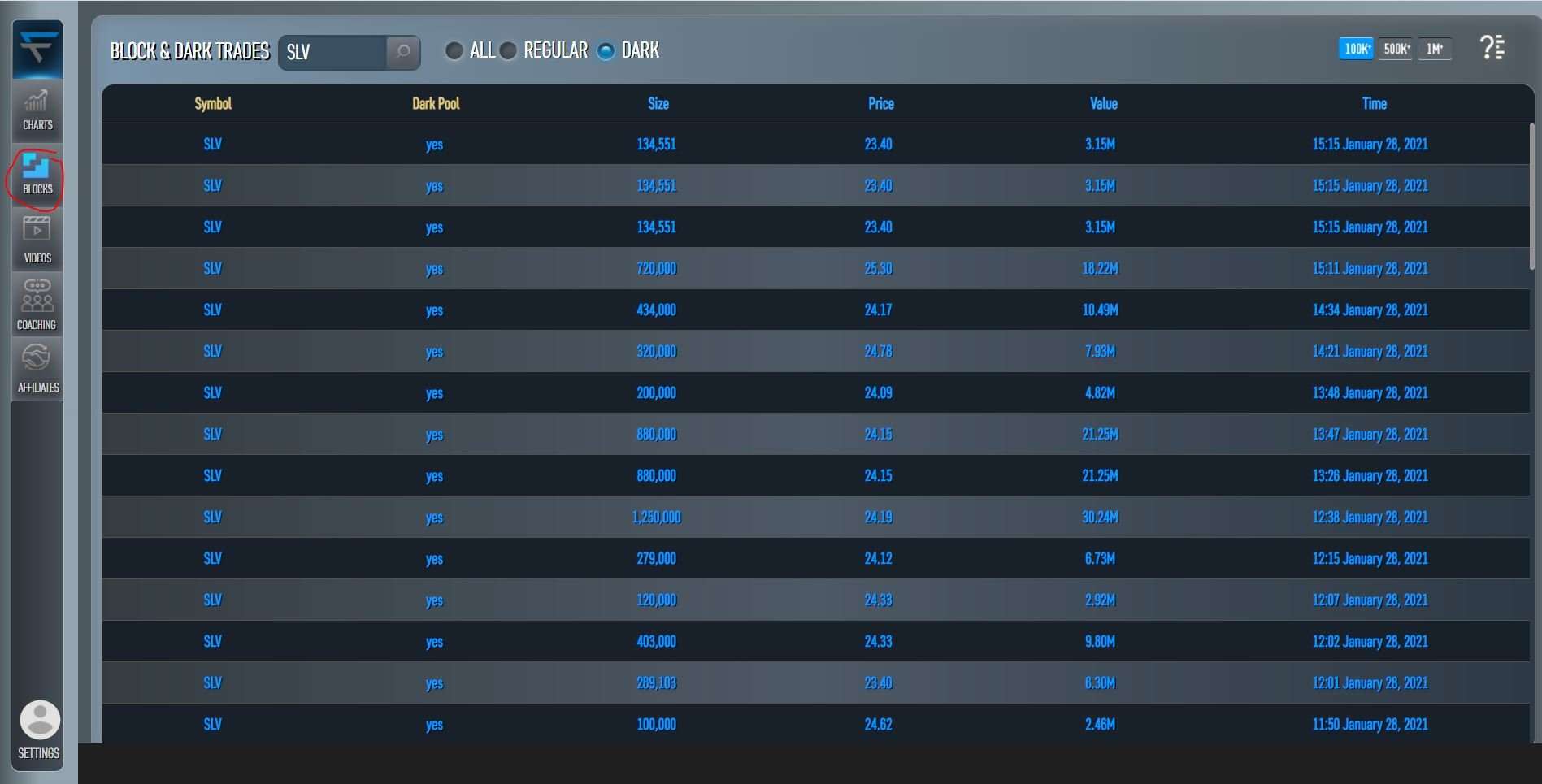

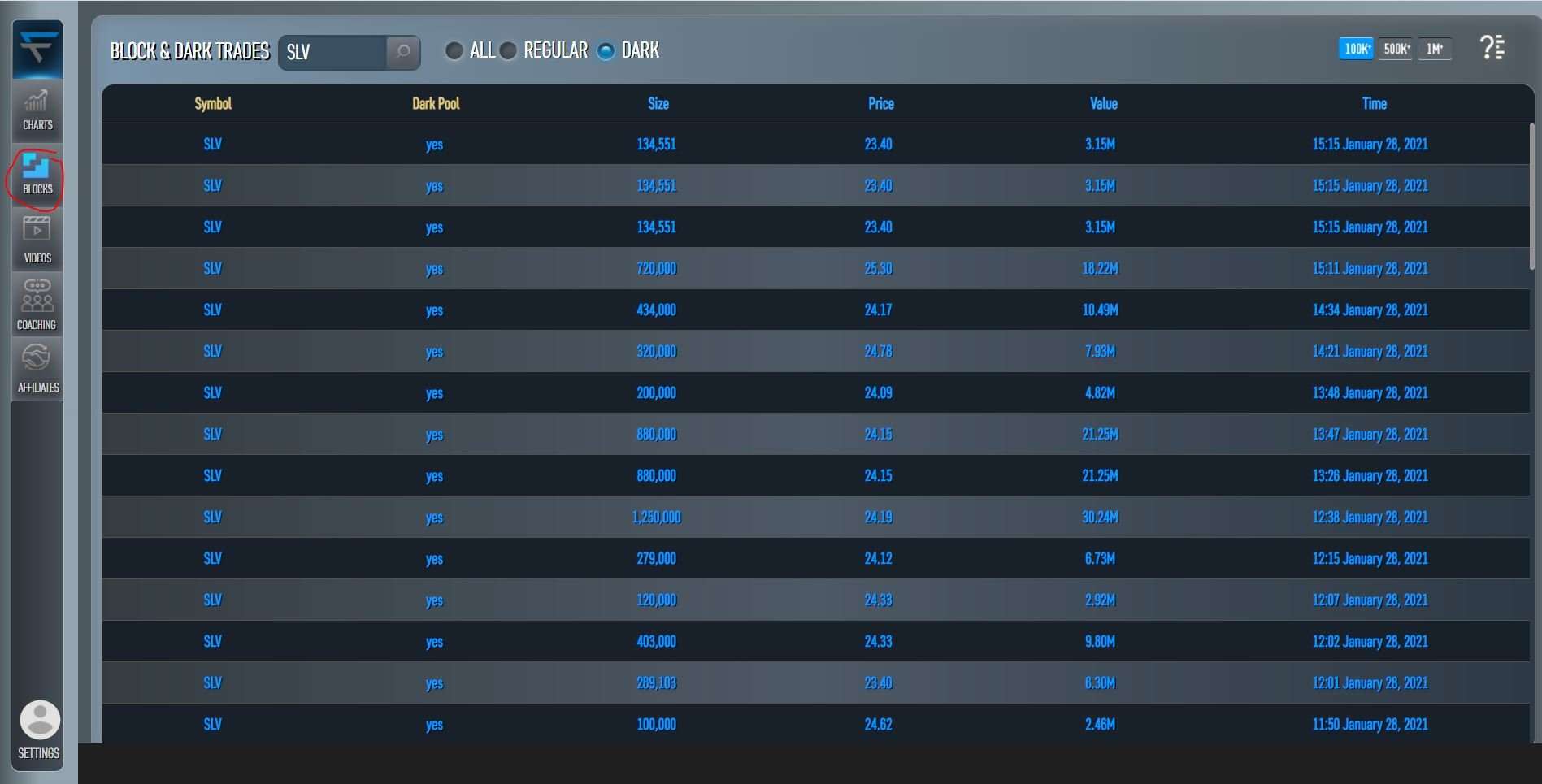

How To See Dark Pool Trades

| Who doesnt want to know how to see dark pool trades? I sure did. The quickest and easiest way to peek into the world of unlit markets is to find a tool that can. And we have such a tool at our disposal called FlowTrade, which gives us data as its reported. These types of prints or trades are the most important types of trades. |

Don’t Miss: How To Get Out Of Contract With Blue World Pools

Why Do Institutional Investors Use Dark Pools

Institutional investors trade in dark pools for two primary reasons:

- Find buyers and sellers for large orders without publicly revealing intentions

- Obtain better pricing for executed trades

Dark pools allow institutional investors to quietly find buyers and sellers for large orders without causing large swings in the market . How is this possible? Dark pools are not required to make the order book available to the public. Instead, transactions executed through dark pools are released to the consolidated tape after a delay.

For example, letâs say an investment bank is trying to sell 400,000 shares on a public exchange like the New York Stock Exchange. As soon as institutional investors or high-frequency traders see a large sell block hit the order book, the markets react, and the security likely would likely decrease in value by the time the investment bank was able to find enough buyers to fill the entire order. However, if the trade is disclosed only after it has been executed, the news has a much smaller impact on the market.

Another reason to fill large equity orders in dark pools is to obtain better pricing. Trades made on dark pools can have lower transaction costs in two ways:

The Rationale For Dark Pools

Dark pools emerged in the late 1980s. According to the CFA Institute, non-exchange trading has recently become more popular in the U.S. Estimates show that it accounted;for approximately;40% of all U.S. stock trades in 2017;compared with an estimated 16% in 2010. The CFA also estimates that dark pools are responsible for 15% of U.S. volume as of 2014.

Why did dark pools come into existence? Consider the options available to a large institutional investor who wanted;to sell one million shares of XYZ stock before the advent of non-exchange trading. This investor could either:

The market impact of a sale of one million XYZ shares could still be sizable regardless of which option the investor chose since it was not possible to keep the identity or intention of the investor secret in a stock exchange transaction. With options two and three, the risk of a decline in the period while the investor was waiting to sell the remaining shares was also significant. Dark pools were one solution to these issues.

Recommended Reading: Salt Water Pool Cost Estimator

There Are Simple Techniques For Seeing What’s Happening In The Dark Pools That Drive The Stock Market And Ways To Make Money Off It

By Will Deener

11:16 AM on Dec 2, 2016 CST

Big cheeses on Wall Street have all the advantages when it comes to trading stocks — no surprise there.

Ever wonder why a stock drops even when the company’s quarterly earnings beat analysts’ expectations. Well, cunning investment rogues are often tipped off well in advance of the earnings release — hence the oft-used aphorism: Buy on the rumor; sell on the news.

Similarly, by the time most companies release a negative press release, it’s old news for the big boys. Company executives, bankers, brokers and hedge funds have already sold their positions. And so it goes.

I shared my market cynicism with Stefanie Kammerman, a savvy New York stock trader who was in Dallas recently attending an investment conference. I asked Kammerman if the stock market is manipulated. Her response was quick and resolute: “Of course it is, completely. There is insider trading; there are people going to jail; come on, there is a lot stuff going on. You have to get past that, but most people can’t.”

Kammerman, managing director of The Stock Whisperer Trading Company, runs an online trading room called The Java Pit. Anyone interested in trading stocks should check it out, but that’s not why I reached out to her.

Large investors daily buy and sell millions of shares of stocks and exchange traded funds anonymously in these dark pools. They have been around for years, and yet few small investors know of their existence, but they should.

What Are The Advantages

Dark pools offer various advantages to its users. What are those advantages?

- Complete Privacy While Executing Trades

Dark pools allow the execution of trades with complete privacy from the general public. Generally, markets and its participants tend to over react to news of big trades. Therefore, dark pools help avoid this problem. The offering of complete privacy avoids unnecessary price reactions.

- The Benefit to Avoid Price and Market Movements

The price of the traded security remains stable because the trades arent known to retail traders. As a result, theres no price overreaction or under reaction due to the executed order.

- Availability of Liquidity and Increased Efficiency

Liquidity and volume is a major part of trading any security. Therefore, dark pools give the big institutions and funds access to huge liquidity to trade millions of shares with ease. As a result, this increases the overall market efficiency, providing an advantage.

Read Also: How To Lower Cya In Pool