What Is Dark Pool Investing

Dark pools, otherwise known as Alternative Trading Systems , are legal private securities marketplaces. In a dark pool trading system investors place buy and sell orders without disclosing either the price of their trade or the number of shares.

Dark pool trades are made over the counter. This means that the stocks are traded directly between the buyer and seller, oftentimes with the help of a broker. Instead of relying on centralized pricing, such as with a public exchanges like the NYSE, over-the-counter traders reach their price agreements privately.

There are three common types of dark pools: broker-dealer owned, agency broker or exchange-owned and electronic market makers. The first type is set up by broker dealers for their clients and may include proprietary trading. These prices come from their own order flow. The second acts like an agent rather than a principal and there is no price discover as the prices come from exchanges. The last type is offered by independent operators and there is no price discovery.

Dark pool exchanges keep their confidentiality because of this over-the-counter model, in which neither party has to disclose any identifying or price information unless specific conditions compel them to. For example, a public institution might have to publish this information due to disclosure laws that have nothing to do with the dark pool.

Presentation And Explanation Of The Algorithm

The greedy algorithm allocates one unit at a time. The venue to which the next unit is allocated is chosen to maximize the estimated probability that the unit will be consumed if v_i units have already been allocated to venue i, then the estimated probability that the next allocated unit will be consumed is simply the estimated tail probability of v_i + 1.

It is important to notice here that the Greedy Algorithm is identical at every timestep. The tail probability estimates are considered to be given beforehand and dont change over time, there isnt any time component anywhere in the process. That will be one of the main differences with the Censored Exploration Algorithm that will be presented later.

A formal description is given as Algorithm 1 below.

Theorem 1.The allocation returned by Greedy maximizes the expected number of units consumed in a single time step.

While not all units are allocated, the greedy algorithm iteratively adds a unit to the venue whose tail probability of the total allocation augmented by one would be the highest.

In order to understand the proof, you just have to note two things:

- The tail probabilities are decreasing functions

- At each step of the algorithm, the maximum tail probability of an increased unit is therefore a global maximum over all the remaining units.

Thus, we can say that at each step of the algorithm, the sum of maxima over all venues and all allocated units is equal to the global maximum of this sum .

A Guide To Dark Pool Investing

There are two reasons one may choose to conduct dark pool trading. First, it could make your job sound far more thrilling than it actually is. Stock analyst might not light up the conversation at a party. Dark pool traders, on the other hand, probably ride motorcycles to work at an undisclosed location. No one will know what you do. And, for security purposes, you cant tell them.

The second, more practical reason is to conduct trades without influencing the . Dark pool investing is a straightforward solution to a relatively common problem. However, its not a problem many retail investors will likely have. Heres a breakdown of dark pool investing.

You May Like: Cleaning Pool Tile With Baking Soda

Review & Adaptation Of The Maximum Likelihood Estimator

We will work with a given venue i.

We define by z the true probability that the demand in this venue is exactly s units given that it is at least s :

Let D be the number of direct observations of s units up to time t, and let Nbe the number of observations of at least s units on time steps at which more than s units were requested. The quantity Nis then the number of times there was an opportunity for a direct observation of s units, whether or not one occurred.

We can then naturally define the empirical probability of a direct observation of s units given that a direct observation of s units was possible, what leads us to the MLE of the tail probability for any s > 0 after t time steps :

Here is what we get when we implement the MLE update in Algorithm 2 :

Weve reached the point where mathematical theory stops helping us :

- There are convergence rates for the MLE to the true underlying distribution in the case that the submission sequence is i.i.d

- There are asymptotic convergence results for non-i.i.d. settings

- We are in the non-i.i.d. case, since the submitted volumes at one venue are a function of the entire history of allocations and executions across all venues, but we would like a finite sample convergence bound.

Theorem 2 :

In Algorithm 3 , the value c can intuitively be viewed as a cut-off point up to which we are guaranteed to have sufficient data to accurately estimate the tail probabilities using the MLE.

Reinforcement Learning For Orders Execution In Modern Quantitative Finance

This article presents a review, discussion and implementation of the paper Censored Exploration and the Dark Pool Problem by Kuzman Ganchev, Michael Kearns, Yuriy Nevmyvaka and Jennifer Wortman Vaughan from the Computer and Information Science department of the University of Pennsylvania. You can find it here.

It is quite long because I try to be exhaustive on themathematical arguments that guarantee the efficiency of the proposed algorithms. I also think it really helps understanding what everything is about. However, if youre unfamiliar or uncomfortable with the concepts, dont hesitate to skip to the maths and jump to the implementation parts.

Since we will meet a lot of difficult financial, mathematical and algorithmic concepts, I am going to decorate this article with heavenly swimming pools which will make you want to plunge always deeper into the subject.

Note from Towards Data Sciences editors: While we allow independent authors to publish articles in accordance with our rules and guidelines, we do not endorse each authors contribution. You should not rely on an authors works without seeking professional advice. See our Reader Terms for details.

Don’t Miss: Can Vdara Use Aria Pool

History And Creation Of Dark Pools

The origin of dark pools dates back to 1979. They decided to change financial regulations in the US. As a result, securities listed on one exchange could trade elsewhere. They no longer had to trade only on the exchange to which they were listed.

This new regulation allowed the creation of dark pools that emerged throughout the 1980s. This allowed institutional investors the ability to trade large block orders and avoid impacting the markets.

This gave them privacy and a method to trade in large quantities without any exposure. As a result, dark pool trading was born. Its good that volume isnt affected.

Dark Pool Indicator And How To Use It

In This Article We Review The Dark Pool Indicator

If youre like most traders on social media right now, youre probably hearing a lot about dark pools. Whether you are someone who bought GameStop or AMC while the stocks were pumping or dumping, or youre someone just getting into trading and following my charts on . The goal we all have is the same. Become a better trader than we were yesterday. The dark pool indicator I will review will be instrumental in helping you achieve that goal.

Read Also: Above Ground Pool Filters Sand Vs Cartridge

Understanding The Dark Pool

Dark pools emerged in the 1980s when the Securities and Exchange Commission allowed brokers to transact large blocks of shares. Electronic trading and an SEC ruling in 2007 that was designed to increase competition and cut transaction costs have stimulated an increase in the number of dark pools. Dark pools can charge lower fees than exchanges because they are often housed within a large firm and not necessarily a bank.

For example, Bloomberg LP owns the dark pool Bloomberg Tradebook, which is registered with the SEC. Dark pools were initially mostly used by institutional investors for block trades involving a large number of securities. However, dark pools are no longer used only for large orders. A study by Celent found that as a result of block orders moving to dark pools, the average order size dropped from 430 shares in 2009 to approximately 200 shares in 2013.

What Is Dark Pool Trading

- To understand dark pool trading, we need to know what it is. Dark pools, or black pools, are privately organized and managed financial exchanges for trading securities. These dark pools arent accessible to the general public. Therefore, are basically unknown to retail and general investors. In other words, dark pools allow big institutional investors to sell and purchase large amounts of securities with complete secrecy and no disclosure until their trades have been executed. This is also known as block trading. These dark pools allow large institutions to execute trades with gigantic quantities and offers them a discreet way to trade.

Recommended Reading: How To Lower Cya In Pool

How To Spot Dark Pool Activity

There are a host of simple tricks you can use to indirectly spot activity in a dark pool. As an individual investor, you cant really peer into the pools themselves. But you can see traces of their transactions on the public markets.

Its a bit like looking out the window to see how windy it is. The wind itself is invisible, but you can indirectly gauge its presence by watching the leaves blow around.

One simple way to spot dark pool activity is by monitoring the internet. Financial journalists are constantly racing to report on big institutional trades. And theyre not easily deterred by something like a private computer network.

If you dont trust the journalists to get the scoop, then consider setting up Google Alerts for various mutual funds and other institutional investors. They are eventually required to disclose all of their trades, even if its a while after the fact. By making sure youre the first to know about dark trades, you can get ahead of the public in making money off of them.

Finally, our Chief Investment Strategist Alexander Green is very familiar with dark pool investing. His years of experience on Wall Street have taught him exactly how to spot these quiet but massive trades.

S 2 & : Exploitation And Exploration Lemmas

In this part, I will not aim at proving every lemma and theorem mathematically or go deeply into technical details, but rather at giving a general intuition of their meanings.

Lemma 2 :

This is a trivial consequence of theorem 2 combined with the formula of cut-off points from algorithm 3.

Lemma 3 :

Lemma 3 shows that it is also possible to achieve additive bounds on the error of tail probability estimates for quantities s much bigger than the cut-off point as long as the tail probability at that cut-off point is sufficiently small.

We are now ready to state our main Exploitation Lemma , which formalizes the idea that once a sufficient amount of exploration has occurred, the allocation output by the greedy algorithm will be epsilon-optimal.

Lemma 4 :

Note that these bounds are tight in the sense that it is possible to construct examples where the equality is obtained.

Finally, we present the main Exploration Lemma , which states that on any time step at which the allocation is not epsilon-optimal, the probability of a useful observation is lower bounded.

Lemma 5 :

Same assumptions. If the allocation is not-optimal, then for some venue i, with probability at least/,

Also Check: Best Pool Decking Materials

Is Dark Pool Trading Legal

- A secondary way for institutions to trade without anyone knowing? Is that even legal? Yes! Dark pool trading is legal. The good news for us retail traders is that dark pools allow the big trades to happen without affecting our trades. Imagine if one of those institutions came in bearish in a stock we were bullish in. Whew! Wed be up a creek without a paddle. Thankfully, Alternative Trading Systems are in place to keep that from happening.

Why Do Institutional Investors Use Dark Pools

Institutional investors trade in dark pools for two primary reasons:

- Find buyers and sellers for large orders without publicly revealing intentions

- Obtain better pricing for executed trades

Dark pools allow institutional investors to quietly find buyers and sellers for large orders without causing large swings in the market . How is this possible? Dark pools are not required to make the order book available to the public. Instead, transactions executed through dark pools are released to the consolidated tape after a delay.

For example, letâs say an investment bank is trying to sell 400,000 shares on a public exchange like the New York Stock Exchange. As soon as institutional investors or high-frequency traders see a large sell block hit the order book, the markets react, and the security likely would likely decrease in value by the time the investment bank was able to find enough buyers to fill the entire order. However, if the trade is disclosed only after it has been executed, the news has a much smaller impact on the market.

Another reason to fill large equity orders in dark pools is to obtain better pricing. Trades made on dark pools can have lower transaction costs in two ways:

Also Check: Best Pool Area In Vegas

One : Overview Vocabulary And Definitions

This paper is not easy to grab at first if you are unfamiliar with some technicalities of modern quantitative finance and reinforcement learning. Here, I will try to do a brief overview of the most important concepts.

First, lets start with the abstract, which will provide us with a more accurate idea of the general topic. It sounds very dense at first glance and it can be difficult to find your way around. I have bolded the phrases that should probably require some explanation for the average reader.

We introduce and analyze a natural algorithm for multi-venue exploration from censored data, which is motivated by the Dark Pool Problem of modern quantitative finance. We prove that our algorithm converges in polynomial time to a near-optimal allocation policy prior results for similar problems in stochastic inventory control guaranteed only asymptotic convergence and examined variants in which each venue could be treated independently. Our analysis bears a strong resemblance to that of efficient exploration / exploitation schemes in the reinforcement learning literature. We describe an extensive experimental evaluation of our algorithm on the Dark Pool Problem using real trading data.

Dark pools are a recent type of stock exchange in which relatively little information is provided about the current outstanding orders.

A learning algorithm receives a sequence of total volumes V_1, V_2, and must decide at each time step t how to distribute the V_t units across the venues.

Why Do Dark Pools Exist

Chiefly, dark pools exist for large scale investors that dont want to influence the market through their trades.

The influence they could potentially have on the market is often known as the Icahn Lift, named after legendary investor Carl Icahn. Its been said that Icahn can influence the price of a stock just by purchasing it. The lift comes when other investors see Icahns interest and jump in, causing the stock price to rise. Hes often seen as a one-man bull market.

This happens to large scale investors, too. When an institutional investor wants to shift assets, it risks creating a price swing due to other investors who see the interest or disinterest and react accordingly. This isnt always a good thing.

Recommended Reading: Does Target Carry Pool Supplies

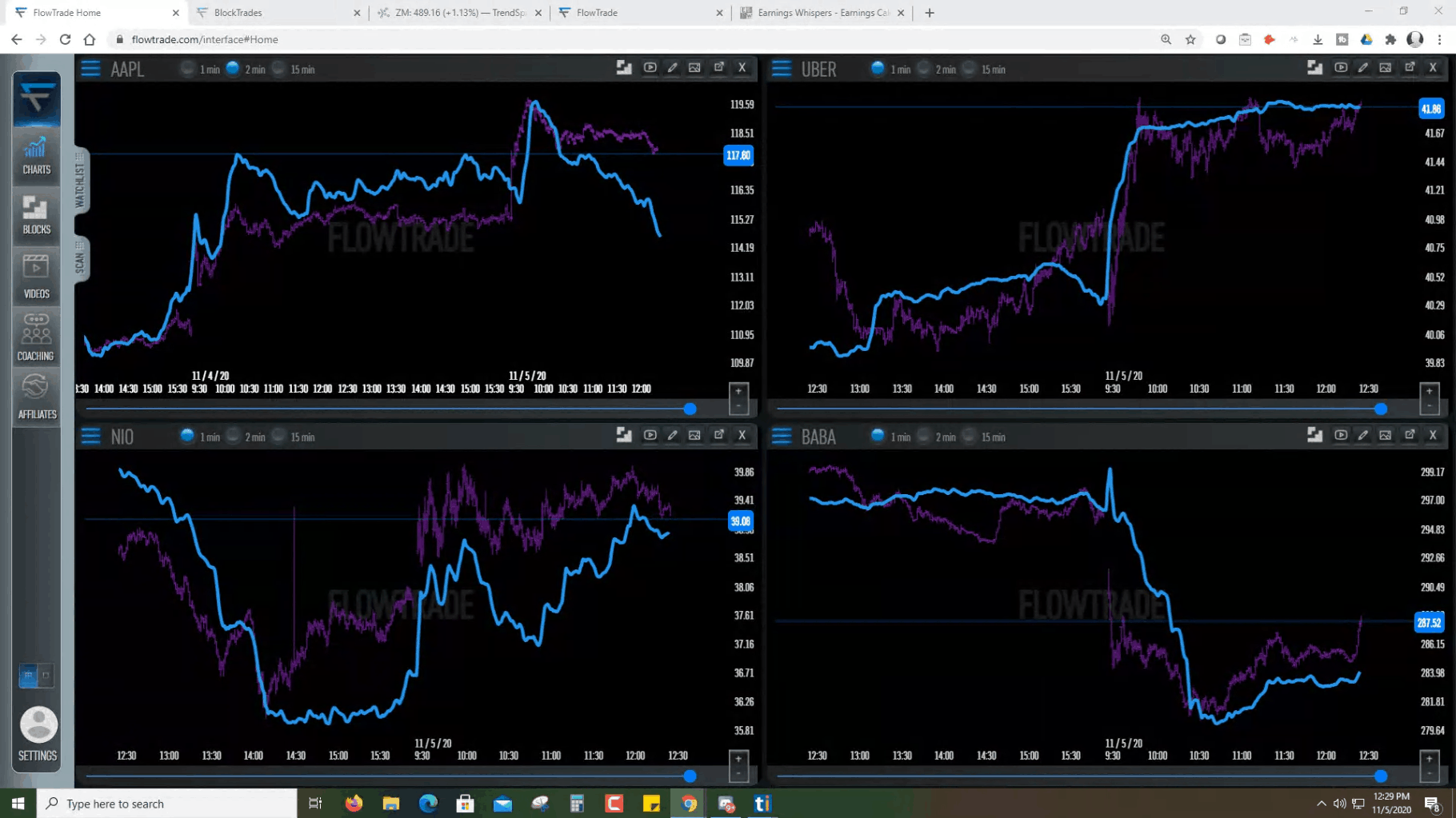

Flowalgo Is A Data Algorithm That Tracks Down Smart Money Transactions In The Stock And Equity Options Markets It Actively Monitors The Tape Market Wide

Smart Money Transactions, Front and Center.

FlowAlgo identifies Smart Money transactions by analyzing various data points on each order as they hit the tape including the order type, order size, the speed of the order, the pattern in which the order fills, the order volume, average volume, among many more.

Realtime, On-Demand, and Algorithmically Curated.

FlowAlgo tracks down only what’s truly valuable. Leaving out everything you don’t want or need. Every order that FlowAlgo reports to you has a high potential of being market moving.

You no longer have to dig for data or maintain complex spreadsheets. Order data is alerted to you in realtime and available at anytime, on-demand.

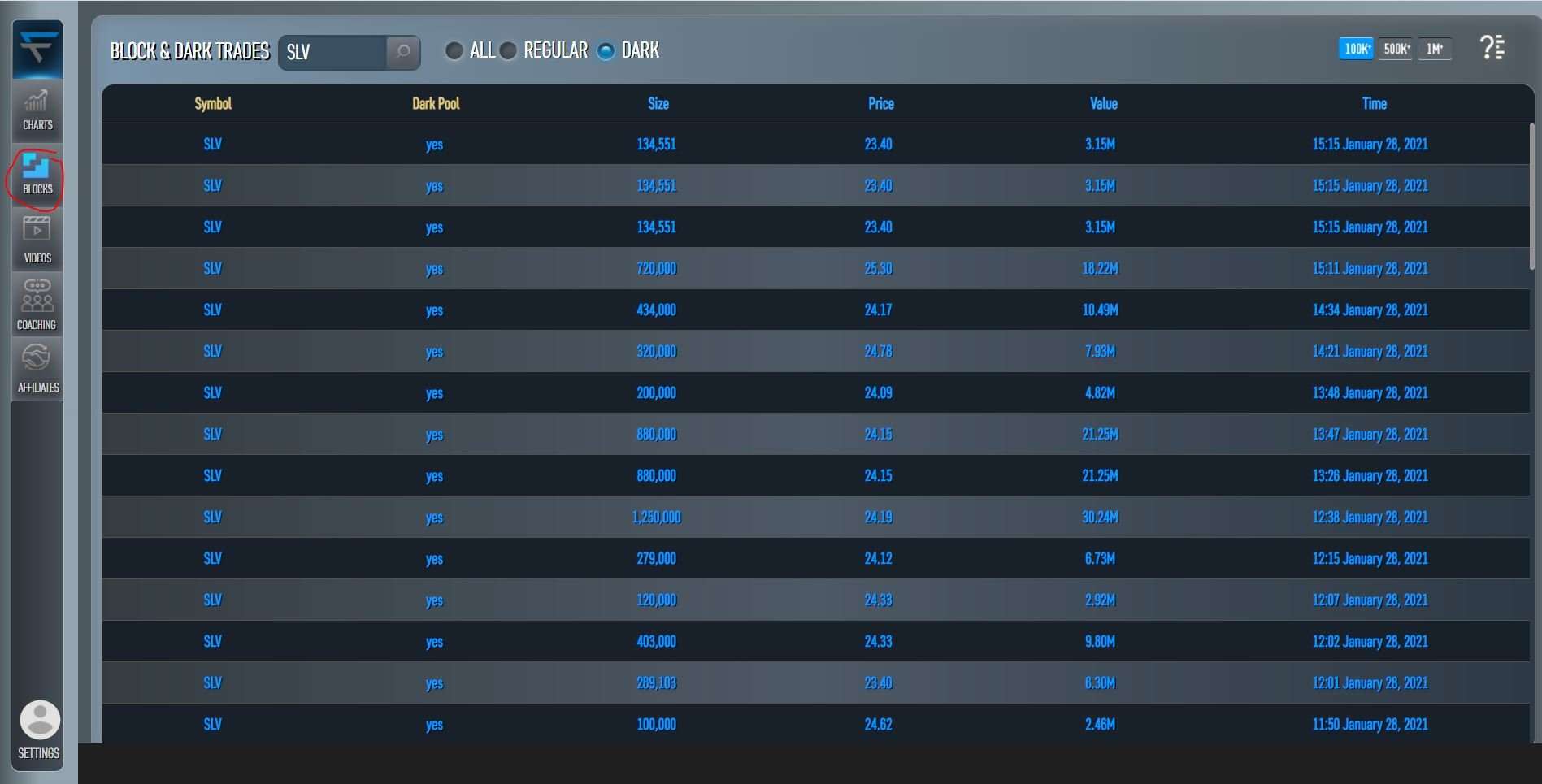

Tips On Trading Dark Pool Prints

Since these orders do not provide us with clear intent on whether the trade was a buy or a sell, we can look at various strategies for clues that can help us get a clearer picture of what could be happening off the exchanges.

Dark pools and options order flow data

One of the best ways to gauge sentiment is to combine it with options order flow data. When youre able to see both data sets, it is much easier to draw conclusions of whether a possible bullish or bearish breakout is imminent. We can look at the following example on Twitter :

On Cheddar Flow, we spotted a large dark pool print come through right at market open with a couple more to follow on September 18th. Looking at the options order flow data, we saw that there was strong bullish sentiment with 83% being on the call side. This was a strong indication that the dark pool orders were being bought by institutions.

On September 23rd, TWTR surged after Pivotal Research upgraded the stock to a buy.

Look for trades that dont hit the tape as much

If you notice a trade that doesnt come through as frequently, check the historical data to get a better sense of how unusual this order is. This may mean an institution is starting to build a position in the stock.

Additionally, pay attention to the stocks average daily volume. If the block order coming in takes up more than 30% of the daily average, this makes the dark pool print very significant and worth watching.

Use the strangle options strategy

Don’t Miss: Can Vdara Use Aria Pool