Swimming Pool Liability Insurance

You may find that it makes sense for you and your family to purchase an umbrella insurance policy to support your homeowners policy. People with above or in ground pools often add this policy to serve as excess coverage in the event of a pool accident to fully protect their assets. An umbrella policy averages up to $1 million in liability coverage and will be activated only when all the funds from the homeowners insurance policy have been exhausted possibly from paying out a potential injury settlement as a result of a pool accident.

A pool can be a great way to enjoy the summer months, but it brings with it a lot of responsibility and liability year around. Whether you have an in-ground pool or an above ground one, protecting your investment and your liability is essential. With the right insurance policy for your pool, you can protect your financial future for many years to come.

Our advisors can help walk you through your current coverage as well as compare quotes to help you save on insuring your pool.

Give us a call today at .

Not by the phone? Request a homeowners quote online:

Does Homeowners Insurance Cover Pool Leaks

Choosing to add a pool to your backyard can amount to endless years of entertainment for you and your family. It can also work to add value to your home and create greater resale value should you choose to move. While a pool is largely a positive thing, it can add some complications when it comes to homeowners insurance.

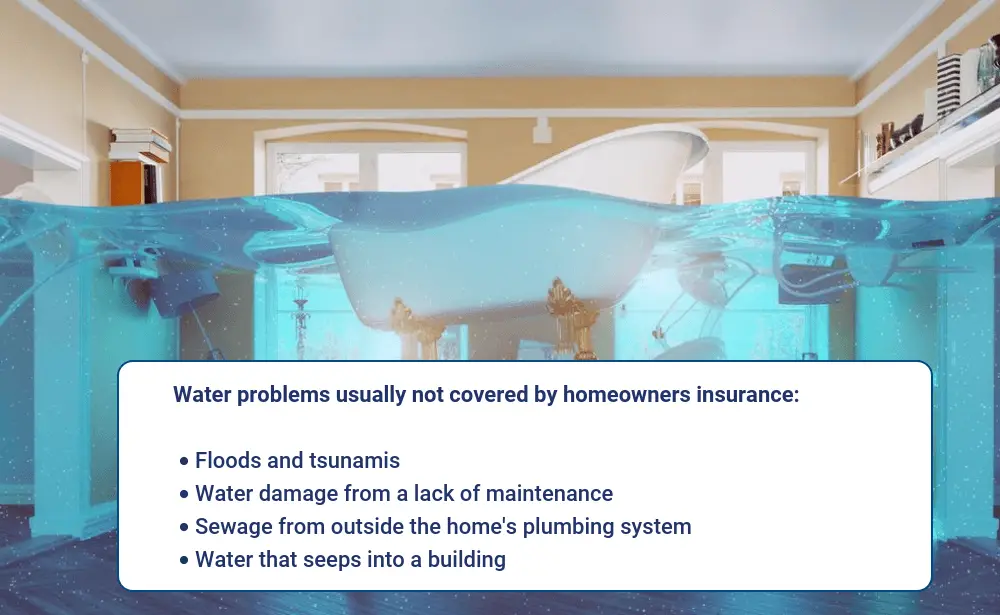

While some aspects and types of pools are covered by your homeowners, certain situations or issues could leave you paying out of pocket. This includes one common issue many pool owners face each year: unexpected leaks.

Does homeowners insurance cover pool leaks? What about other types of damage? Lets explore the relationship between pools and insurance a bit more below.

Do I Need A Hurricane Deductible

Almost every state on the Atlantic coast allows insurers to charge special deductibles for hurricane damage, but depending on your insurer and the state you live in, you may have the option to pay higher premiums in exchange for a lower, fixed-price deductible.

You can also leave the deductible off of your policy altogether for a reduced premium, but this might be a bad idea if you live in an area at high risk of hurricanes since youâre essentially forfeiting coverage from hurricane damage.

Read Also: How Much Liquid Chlorine To Add To Pool Calculator

For The Majority Of Cases The Insurance Carriers Will Cover The Water Damage As It Is Deemed Sudden And Accidental Which Is A Covered

Does homeowners insurance cover frozen pool pipes. Fortunately, a homeowners insurance policy will cover the additional liability resulting from the ownership of a pool as long as its included in your homeowners policy. It’s all bad news, from a full flood to significant water damage. The only worse information that could come along will be the news that your insurance provider refuses to pay for the damage.

Most water damage is covered. With this damage comes the inevitable worry as to whether homeowners policies will cover the losses that are incurred. This is because water damage, which includes frozen pipes, is a leading cause of homeowners insurance claims.

Protect your pipes before cold weather arrives with these five easy tips: 5 ways to prevent frozen pipes. However, it should pay for any damage the water causes to items like floors, ceilings.

Your homeowners policy will cover the damage done to the house to get to the pipes in order to replace them, but not for the replacement of the pipes themselves. It is important to determine the cause of the damage to know whether or not the insurance policy will cover it. Homeowners insurance typically covers the destruction and damage caused by gushing water.

Given the possible exception to the freezing exclusion, the. A fire or a damaging windstorm), your homeowners insurance will not cover the pool leak or accrued damages. Unless a leak was caused by peril (ie:

Pin On Home

Can I Get Airbnb Pool Insurance

Pools can make insurance for Airbnb a bit more complicated. Youll need to look at insuring your entire home while using it as a rental property. Not all Ontarian cities have developed thorough policies about short-term rentals using this service, but insurance companies have had this figured out for a while.

You can definitely buy home insurance policies that cover both short-term and long-term rental coverage from certain companies. However, those options arent a part of most standard home policies. Youll need to ask for the additional coverage and price it out with your current provider.

If you manage several properties for short-term rentals, then you might even need to consider purchasing a commercial property insurance policy.

Also Check: How To Read Clorox Pool Test Strips

Is Damage To The Pool Covered

Whether or not physical damage to your pool is covered will depend on your insurer.

Some insurers will cover damage to your pool under Coverage B other structures, while other insurers may not cover physical damage to your pool at all. You can get a special rider for your pool or look at other policy options if your current policy doesnt cover the structure of the pool.

Some insurers look at an in-ground pool, made of cement, similar to how they look at foundation damage to your homeits your responsibility to ensure cracks in the cement are repaired when observed.

When it comes to pool maintenance equipment, such as filters and pumps, coverage is normally afforded by a homeowners insurance policy under Coverage B other structures. If its a matter of normal wear and tear, this type of swimming pool equipment may not be covered. If you dont replace it regularly and something goes wrong, it could be seen as a sign of neglect leading to future claim denials.

Does Homeowners Insurance Cover Pool Collapse

Homeowners insurance covers pool collapse if the collapse is a result of a covered peril. Unfortunately, most pool collapses arent the result of a covered peril, though.

A covered peril is another term for a potential source of damage. Many of the perils that your insurance protects your home from dont really apply to your pool, like fire, theft, and wind damage . So, your pool would likely be covered if a tree was blown over by a hurricane and damaged the frame, or your above-ground pool got destroyed by a tornado. But, pool collapses arent always destroyed by covered perils.

Above-ground pools often collapse due to the weight of ice or snow that accumulates on them during the winter. Damage like this could be covered, but oftentimes an insurer may believe that your negligence caused the damage and deny reimbursement. This brings us to our first obstacle with swimming pool insurance coverage: negligence.

If you couldve done something to remove the snow, or there was a pre-existing issue with the pool in the first place, your insurer wont cover the damage. For instance, the pool may have been improperly built or installed. Was there excessive rust, or a remarkably old liner? Your insurer will look at all these possibilities. Pools usually dont collapse on their own if theyre properly kept, and your provider will expect you to perform regular maintenance on your pool to keep it in working order.

Read Also: Can Vdara Use Aria Pool

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most price, customer service, policy features and savings opportunities so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure were putting accuracy first.

Am I Liable If Somebody Is Injured Using My Pool Without Permission

Unfortunately, if a person is trespassing and using your pool without permission, you could still be held liable for any injuries this person may suffer.

To protect yourself from something that appears so frivolous, you should follow the laws and guidelines for the upkeep and security of your pool, according to legal experts. Here are a few tips to make your pool safe and secure:

- Install non-slip flooring around your pool

- Use a pool cover when not in use

- Set a pool alarm to alert you when someone enters the water

- Keep pool water clean

- Remove ladders from above-ground pools when not in use

You May Like: How To Take Calcium Off Pool Tile

Does Homeowners Insurance Cover Swimming Pools

If you own a pool in your home, having proper insurance coverage for the risks that come with owning a pool is important. Yes, homeowners insurance does cover a swimming pool. However, not all insurers cover swimming pools and some of those who do actually require pool owners like you to take steps to minimize your risk, like adding safety features or fencing your property in.

Because not all insurers cover swimming pools, the best way to cover your pool property is not with pool insurance but to work with an insurance agent who will help you look for a homeowners insurance coverage that will also cover your pool.

While many pool owners believe that their homeowners insurance policy will cover their pools, the sad truth is that that is not always the case. Many insurance companies just dont cover pools based on their own independent underwriting guidelines, so as a pool owner, it is imperative for you to assess your current home insurance policy to determine if it allows for any kind of pool. Dont take this for granted, because if you fail to disclose your pool to your insurer, then your insurer will have the right to drop your entire policy altogether and render it void.

What Does Swimming Pool Insurance Cover

Your insurance policy protects your home and other structures on your property from perils which is an industry term for damage caused by events out of your control such as weather, fire, vandalism or theft.

For example, if a tree falls into your swimming pool after a weather event, or lightning strikes your pool and damages its components, your insurance will help pay for repairing or replacing the damage.

The amount of coverage you get for any property damage depends on the deductibles you choose and the policy limits. Since limits to your policy vary, it pays to carefully review plan limits to see if theyre adequate to cover any damage to your pool.

However, if a peril such as an earthquake, flood, mudslide, sinkhole or sewer backup causes damage, your pool isnt covered under your standard home insurance policy.

Also, many policies dont protect pools from damage caused by frozen pool water. If you live in a colder climate, you should drain your pool when temperatures start regularly dipping below freezing.

Also Check: Wall To Hide Pool Equipment

Consider Increased Liability Protection

Whats worse, an injured party might sue and win a court-ordered award.

Between an injured partys medical bills and a court-ordered award, you could end up paying tens of thousands of dollars out of pocket.

An injured person could sue for hundreds of thousands of dollars. In which case, $100,000 of base liability protection might not be enough.

For added protection, you can increase your personal liability protection to $300,000 or $500,000 .

What Type Of Pools Fall Under Other Structures

When you notify your home insurance provider to list a swimming pool on your policy, youll provide details about the type of pool.

This is important because the type of pool determines whether theyll list it as an other structure or personal property.

Home insurance policies only cover two types of pools:

- permanent above-ground pools

Read Also: Clorox Bleach In Pool

How It Works: Homeowners Insurance With A Pool

If you already have an in-ground or an above ground pool in the backyard covered by your home insurance policy and someone gets injured, your policy will offer liability coverage for protection. However, these limits may not be enough to cover the costs of a persons medical care and any financial reward that an injured person could be awarded through a civil lawsuit against you.

The liability risks a pool poses to your family are often greater than the typical liability limits offered by homeowners insurance policies. A standard home insurance policy offers $100,000 in coverage, but you may want to increase it to at least $300,000 to give your family peace of mind if you have a pool. If that is not enough coverage, consider adding an umbrella policy.

Your homeowners insurance also helps protect your home and property from certain damages. Damage that is covered by most home insurance includes such things as theft, vandalism, lightning, or pipes freezing. Damage from fire, wind, hurricane, and hail is also typically covered. However, these are not typical things that will damage a backyard pool . Instead, damage is commonly caused by earthquakes or maintenance issues, which are not covered by most home insurance policies. Earthquake coverage can be purchased as a separate policy, but be sure to check with your agent that coverage will extend to your pool or call us to review at .

Swimming Pools And Insurance: What Nobody Tells You

Having a pool in your backyard is undeniably awesomeexcept when it comes to cleaning it and figuring out how much its going to affect your home insurance rates .

Does homeowners insurance cover swimming pools? Definitely. But there are some angles that not everyone considers before installing one or buying a house with one in the backyard. Weve put them together here so that you know what to expect at every step of the way, including how insurance for swimming pool contractors works for you as the pool owner.

Don’t Miss: Cleaning Pool Plaster

Limits To Landscaping Coverage

The coverage limits for landscaping on a standard homeowners insurance policy can be minimal, especially if youve had extensive work done on your yard. Most policies have a maximum of trees, plants, and shrubs coverage for 5% of the replacement cost coverage of your home. There can be further caveats that no single plant can cost more than $500 to remove or replace.

Many policies will also exclude landscaping damage from pests, hail, and windstorms from coverage. Additionally, as flood insurance need to be purchased separately, water damage to your yard from flooding wont be covered either. Clearly, there are many stipulations you have to consider to understand what parts of your lawn will actually be covered in the event of extensive damage.

Ranked #1 In America Second Year In A Row

Lemonade was voted the most loved insurance in Americaby Supermoney, Forbes, Clearsurance, JD Power, and others.

gsiener

SunnyTheSailorMan

App Store

Thank you guys for making the insurance buying process hassle free & offering better prices than any other insurance companies out there. I had State Farm & Allstate in the past. Glad I dont have to deal with them anymore.

Takasan

Karen Condren

Google Play

Fantastic, painless experience!! Best way to get your home insured. Love this!! Who knew getting insurance could be headache free..!!?? Highly recommend!!

Michael Schmidt

mschmidt10k

JO87__

App Store

Their AI technology is 5 stars. I was able to get home insurance at a better rate with the same coverage as my previous insurance. They made it easy to integrate their insurance with my current mortgage lender. All this in less than 20 mins

Michael Wieder

Saurabh Mittal

Google Play

The whole Lemonade team handled my house claim with a great sense of urgency, keeping me informed at every step from filing a claim, assessing the damages and the final payment. I strongly recommend Lemonade for Homeowners Insurance.

Mattan Griffel

Dda0307

App Store

40% cheaper than Farmers. It took me less than 3 mins to get a quote and sign up. I hated emailing back and forth or calling my Farmers insurance for every little thing. With Lemonade, everything is on this one app

gsiener

SunnyTheSailorMan

App Store

Takasan

Karen Condren

Google Play

Michael Schmidt

mschmidt10k

JO87__

Also Check: How To Lower Cya In Pool

Who Files The Claim

As I searched through different websites that educate people on how homeowner insurance works, how to file a claim, and what situations the homeowner is liable for, I came across a pretty decent answer.

In a nutshell, if a piece of your property damages your neighbors property, then your neighbor has to file an insurance claim.

Your neighbor has to file the claim because their house or their property has been damaged.

Anytime there is some damage to the house, the insurance company must know about it, even if it is not enough to file a claim.

How Hurricane Deductibles Work In Homeowners Insurance

A deductible is the out-of-pocket amount that youâre responsible for paying on a claim before your insurance company will reimburse you for the remainder of a loss. Formost covered losses, youâll pay a standard dollar amount deductible like $500 or $1,000.

But if your policy has ahurricane deductible, youâll be required to pay that separate amount on a claim involving wind damage from hurricanes. Hurricane deductibles are typically a percentage â usually 1% to 5% but sometimes higher â of your homeâs insurance amount. If your deductible is 3% and your home is insured for $400,000, youâll have to pay a $12,000 deductible before your insurer will cover the remainder of your loss.

Don’t Miss: Easy Ways To Heat Above Ground Pool