Advantages And Drawbacks Of Dark Pools

The main advantages of dark pools include a reduced market impact for large block trades, so that institutional investors are able to get a better price than they would if they executed their orders on regular exchanges, and lower transaction costs, since no exchange fees are charged on dark pool trades.

On the other hand, dark pools have many drawbacks. The main drawback is that their lack of transparency can lead to the mispricing of securities on regular exchanges. Unaware investors may pay too much for a security, which can collapse in value once a large dark pool order on that stock is disclosed to the public.

The presence of a conflict of interest between dark pool participants and the broker-dealers own proprietary traders who may trade against the client is also a rising controversy a point that Lewis stressed in his book Flash Boys. Broker-dealers can also provide special access to the dark pool to high-frequency traders, who may profit at the expense of dark pool participants.

Dark pools are also draining liquidity from public exchanges, especially with their recent rise in trading volume. The main concern associated with this is that open market price discovery is becoming increasingly difficult, and that lower liquidity on exchanges leads to higher transaction costs with Bid/Ask spreads also increasing.

The Rationale For Dark Pools

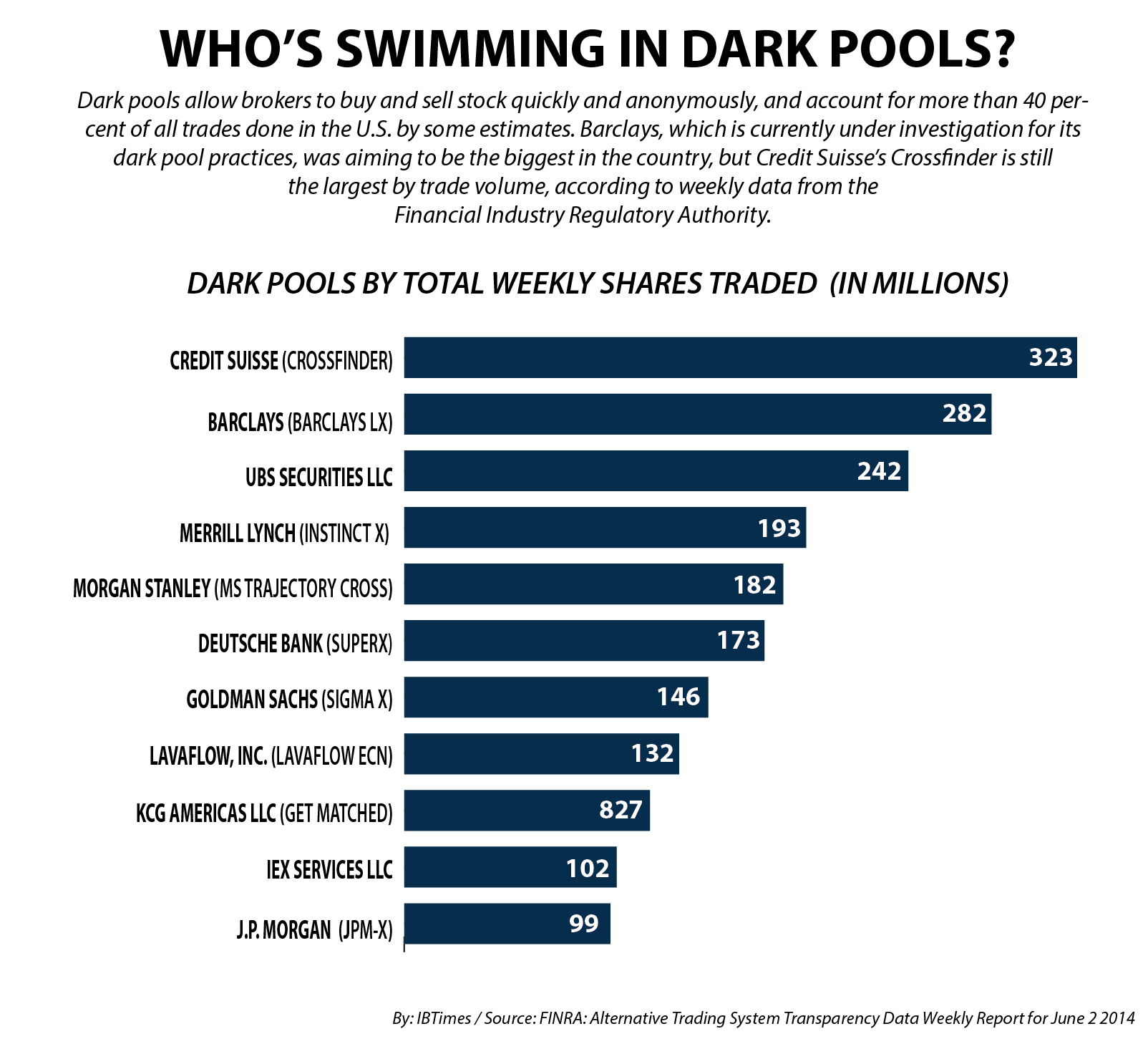

Dark pools emerged in the late 1980s. According to the CFA Institute, non-exchange trading has recently become more popular in the U.S. Estimates show that it accounted for approximately 40% of all U.S. stock trades in 2017 compared with an estimated 16% in 2010. The CFA also estimates that dark pools are responsible for 15% of U.S. volume as of 2014.

Why did dark pools come into existence? Consider the options available to a large institutional investor who wanted to sell one million shares of XYZ stock before the advent of non-exchange trading. This investor could either:

The market impact of a sale of one million XYZ shares could still be sizable regardless of which option the investor chose since it was not possible to keep the identity or intention of the investor secret in a stock exchange transaction. With options two and three, the risk of a decline in the period while the investor was waiting to sell the remaining shares was also significant. Dark pools were one solution to these issues.

What Are The Advantages

Dark pools offer various advantages to its users. What are those advantages?

- Complete Privacy While Executing Trades

Dark pools allow the execution of trades with complete privacy from the general public. Generally, markets and its participants tend to over react to news of big trades. Therefore, dark pools help avoid this problem. The offering of complete privacy avoids unnecessary price reactions.

- The Benefit to Avoid Price and Market Movements

The price of the traded security remains stable because the trades arent known to retail traders. As a result, theres no price overreaction or under reaction due to the executed order.

- Availability of Liquidity and Increased Efficiency

Liquidity and volume is a major part of trading any security. Therefore, dark pools give the big institutions and funds access to huge liquidity to trade millions of shares with ease. As a result, this increases the overall market efficiency, providing an advantage.

Recommended Reading: Cost To Acid Wash A Pool

Citadel Securities And Citadel Connect

If you havent been following the WallStreetBets saga across multiple Senate Banking Committee hearings, here is a brief recap. As the largest Designated Market Maker on the NYSE, and accounting for 47% of US-based retail trading volume, Citadel Securities LLC also accounted for a significant portion of Robinhoods Q1 2021 revenue thanks to Robinhoods PFOF business model.

PFOF is a highly controversial practice because it tends to cause conflict of interest, which is why it is illegal in many Western nations . Current SEC Chair Gary Gensler noted some avenues for its abuse on .

Payment for order flow raises a number of important questions. Do broker-dealers have inherent conflicts of interest? If so, are customers getting best execution in the context of that conflict? Are broker-dealers incentivized to encourage customers to trade more frequently than is in those customers best interest?

In the same statement, Gensler further noted that around 9% of Januarys trading volume was executed on alternative trading systems , commonly referred to as dark pools. Befitting their moniker, dark pools have the effect of occluding the markets resolution. In stock market jargon, the aggregate quote reporting on the bid-ask quote spread the National Best Bid and Offer is skewed, as noted by Gensler himself:

First, as evidenced in January, nearly half of the trading interest in the equity market either is in dark pools or is internalized by wholesalers.

Amcs Dark Pool Trading Volume

Data reported of AMC trades suggests that an average of 64% of shares bought and sold over the past 20 days have come from dark pools. As a benchmark, in the US, estimates suggests that 40% of all executed trades are completed in dark pools and about 20% in Europe. An actively traded stock like Apple – Get Apple Inc. Report sees 50% of its activity happen in dark pools Tesla – Get Tesla Inc Report 53% and Microsoft – Get Microsoft Corporation Report 40%. Also, 43% of meme peer GameStops – Get GameStop Corp. Class A Report trading volume happens in dark pools.

AMCs elevated dark pool trading helps to raise retail investors suspicions. Market making firm Citadel Securities tweeted for the first time on the topic and defended itself from accusations of retail trading irregularities, calling it absurd.

You May Like: Vdara Hotel Pool

Nasdaq Acquires Minority Stake In Us Equity Dark Pool Level Ats

The exchange joins existing investors of the equity dark pool trading venue Bank of America, Citi, and Fidelity.

Nasdaq has acquired a significant minority stake in the US-based equity dark pool trading venue, LeveL ATS.

Originally launched in 2006, LeveL ATS is an alternative trading system that provides a continuous crossing platform for users to trade in a dark pool environment, allowing them to minimise information leakage and market impact.

Existing investors in the dark pool include Bank of America, Citi, and Fidelity.

As one of the most innovative and well recognised broker-neutral trading platforms across US equities, LeveL has demonstrated the ability to consistently meet the evolving needs of investors and serve as an important source of liquidity for its members, said Tal Cohen, executive vice president and head of North American markets at Nasdaq.

We are pleased to join several leading sell-side firms to build on LeveLs suite of products and current market position.

Elsewhere, London-based market maker XTX Markets also launched a US equities dark pool in April earlier this year and confirmed that Barclays had become one of its first broker partners.

In a rapidly changing market landscape, our independent operating model has given us the ability to scale and expand our product and service offerings, said Whit Conary, chief executive officer at LeveL ATS.

Is The Sec Looking Into Dark Pools

In a recent article regarding the high possibilities of automated margin calls, I point out some research I found on Gary Gensler, Chairman of the SEC.

He publicly announces that the SEC has been observing hedge fund activities since January and are taking action to regulate these entities shorting AMC and other meme stocks.

One of Garys proposals states that hedge funds could face 13-F filings. These filings would provide the SEC with insight on equity as well as dark pool disclosure.

I trust we will begin to see this new chairman make the right calls. Its time for change and our generation will be the ones to make it happen.

Also Check: Vdara Hotel Las Vegas Pool

Benefits Of Dark Pools

Dark pools offer advantages, mostly to the institutional investors who benefit with the fact that their trading information is not public. As such, the investor is buying blocks of shares, is able to keep their information private and thus buy at a good price.

Also, these buyers are able to keep their transactions anonymous. In addition, among the dark pool providers, there is also excellent trade execution. Finally, there is the benefit of using this data in high-frequency trading.

What Is Dark Pool Trading

- To understand dark pool trading, we need to know what it is. Dark pools, or black pools, are privately organized and managed financial exchanges for trading securities. These dark pools arent accessible to the general public. Therefore, are basically unknown to retail and general investors. In other words, dark pools allow big institutional investors to sell and purchase large amounts of securities with complete secrecy and no disclosure until their trades have been executed. This is also known as block trading. These dark pools allow large institutions to execute trades with gigantic quantities and offers them a discreet way to trade.

Read Also: Is Aria Pet Friendly

Is Dark Pool Trading Legal

- A secondary way for institutions to trade without anyone knowing? Is that even legal? Yes! Dark pool trading is legal. The good news for us retail traders is that dark pools allow the big trades to happen without affecting our trades. Imagine if one of those institutions came in bearish in a stock we were bullish in. Whew! Wed be up a creek without a paddle. Thankfully, Alternative Trading Systems are in place to keep that from happening.

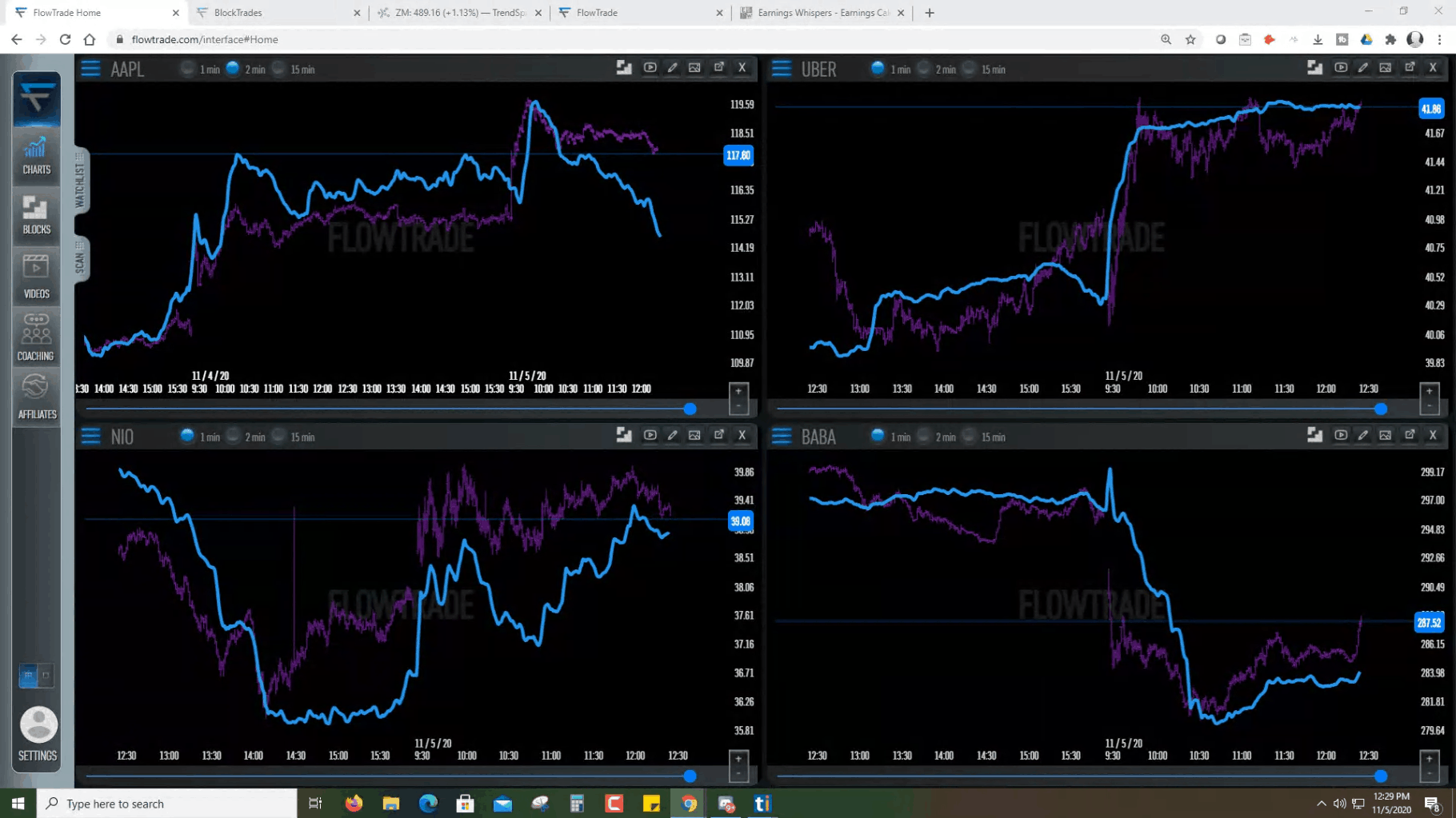

How To See Dark Pool Trades In Real Time

So, you see its pretty simple to see dark pool trades in real time. You just need a subscription to Flowtrade, and to practice using the scanner. Dont forget to click on Show More Block Trades so you can see extra trades that have hit on the scanner previously. Also know that not every stock has dark pool activity. Some are penny stocks, or are on OTC exchanges, and the dark pool institutions are not interested in trading them.

Youll also see me post tweets like this on Twitter:

The columns above show symbol, dark pool yes, size = shares. Price is the price reported for the trade, value is the dollar amount of the trade, and time is in Eastern Standard Time with the date reported.

If you want a good site for totaling your columns up, simply copy and paste your data into . Then, highlight the column you want to have total. I like finding the total of the VALUE column and seeing how much money was in the dark pool. Copy only that column like so:

Next you want to paste it into column calculator site I found.

Recommended Reading: Big Lots Pool Shock

History And Creation Of Dark Pools

The origin of dark pools dates back to 1979. They decided to change financial regulations in the US. As a result, securities listed on one exchange could trade elsewhere. They no longer had to trade only on the exchange to which they were listed.

This new regulation allowed the creation of dark pools that emerged throughout the 1980s. This allowed institutional investors the ability to trade large block orders and avoid impacting the markets.

This gave them privacy and a method to trade in large quantities without any exposure. As a result, dark pool trading was born. Its good that volume isnt affected.

Uses Of Dark Pools Of Liquidity

Dark pools are legal and monitored by the SEC. FINRA makes dark pool data available after the fact, once the trade has been executed and recorded.

Think theres something fishy about not being able to see half of all market activity?

Regulators insist there isnt. They say investment firms that use dark pools of liquidity to move units do the market a favor by adding liquidity.

Without liquidity, you dont have dependable executions Thats the biggest reason I tell my students to stay away from low-volume stocks

The counterpart to this liquidity is its use by market makers. Market makers helped create the tight spreads of modern trading and theyve done it alongside dark pools. More on this later

Some traders have found direct uses for dark pools in their strategy. They learn the methods of dark pool ordering. That knowledge gives them a potential edge over the vast majority of traders who are ignorant of dark pools.

Also Check: Building My Own Inground Pool

What Dark Pool Trading Volume Says About Amc Stock

AMC investors long battle against dark pools is far from over. Apes believe that lack of trading transparency drags – Get AMC Entertainment Holdings, Inc. Class A Report stock price, while market makers and large investment firms with short positions benefit.

Figure 1: Dark pool image.

Why Use A Dark Pool

Contrast this with the present-day situation, where an institutional investor can use a dark pool to sell a one million share block. The lack of transparency actually works in the institutional investors favor since it may result in a better-realized price than if the sale was executed on an exchange. Note that, as dark pool participants do not disclose their trading intention to the exchange before execution, there is no order book visible to the public. Trade execution details are only released to the consolidated tape after a delay.

The institutional seller has a better chance of finding a buyer for the full share block in a dark pool since it is a forum dedicated to large investors. The possibility of price improvement also exists if the mid-point of the quoted bid and ask price is used for the transaction. Of course, this assumes that there is no information leakage of the investors proposed sale and that the dark pool is not vulnerable to high-frequency trading predators who could engage in front-running once they sense the investors trading intentions.

You May Like: How Much Does An Inground Pool Cost In Mississippi

Dark Pools Of Liquidity: The Bottom Line

Dark pools of liquidity are a reality of the modern trading environment. Traders might be better off without them

Or worse.

At this point, its all academic.

To me, traders are better off knowing how they work. Its a necessary part of a good trading education.

I never want my students to be surprised by anything that happens on the market. Knowing what to watch for is the only way to become a self-sufficient trader.

What do you think about dark pools of liquidity? Let me know what you learned in the comments I love hearing from you!

Disclaimer

How Does It Work

Dark Pool orders can only be matched with other Dark Pool orders.

Because the Dark Pool is an invisible order book, as a risk precaution we removed market orders . Only limit orders are allowed.

Limit orders on the Dark Pool execute when they “cross” each other. That is why Dark Pool minimums are large so traders cannot easily find where the other side of the book is.

In the Dark Pool you will not know if you will be maker or taker, so we removed the fee distinction between the two. Everyone follows the same fee structure.

Also Check: How To Build An Infinity Pool

High Frequency Trading With Dark Pools

High-frequency trading is dominating volume these days and investors should be thankful for supercomputers equipped with such algorithms that place the orders in just milliseconds.

With the help of HFT technology, institutional investors can trade multi million share bulk orders ahead of rival investors to capitalize on increase or decrease in share prices.

In brief, the high frequency trading gives institutional investors a huge legal advantage over the rest of the market.

Institutional investors are able to trade using HFT several times a day.

Contra Midpoint Only Plus Orders

Like DRK Midpoint Peg orders, the Contra Midpoint Only Plus order is priced at the midpoint of the Protected NBBO. However, all CMO+ orders are subject to a randomized 400 to 600 millisecond delay upon entry, and can choose to interact against only other resting CMO+ orders or against all resting midpoint-eligible dark liquidity. Once resting, CMO+ orders will only execute against incoming CMO+ orders that have been subject to the randomized delay, increasing the likelihood of trading only against contra-side orders that have a similar longer-term investment objective.

Don’t Miss: How To Clean Pool Tile Grout

Additional Dark Order Features And Conditions

Users of Dark Orders are able to reduce signaling and information leakage that can result in market impact through the use of Minimum Quantity and Minimum Interaction Size conditions. MinQty and MIS are optional instructions that may be submitted on Dark Orders and SDL orders.

Minimum Quantity: Use of MinQty prevents a Dark Order or SDL Order from trading, unless the total tradable volume meets or exceeds the volume specified in the MinQty instruction.

Minimum Interaction Size: The MIS instruction determines the minimum size that any single contra-side order must be in order to be eligible to trade against the MIS order’. For determining whether a contra-side order can trade against a MIS order, eligibility is based on the entered size for an incoming contra-side order, and the total remaining volume for a resting contra-side order.

Critiques Of Dark Pools

Although considered legal, dark pools are able to operate with little transparency. Those who have denounced HFT as an unfair advantage over other investors have also condemned the lack of transparency in dark pools, which can hide conflicts of interest. The Securities and Exchange Commission has stepped up its scrutiny of dark pools over complaints of illegal front-running that occurs when institutional traders place their order in front of a customers order to capitalize on the uptick in share prices. Advocates of dark pools insist they provide essential liquidity, allowing the markets to operate more efficiently.

Read Also: Intex Pool Heaters